The secret has been out about corporate spin offs since Greenblatt released his book in 1997 – but you can still find examples of great corporate spin offs today.

And, yes, a lot of people have started looking at spin offs… but that does not mean that the opportunity has passed. Far from it.

Over the last decade, investors have had the opportunity to pick up a number of highly lucrative spin offs and make a huge amount of money.

In this article, I want to review some of the best because knowing what to look for is sure to make you a better investor.

3 Outstanding Corporate Spin-Off Examples

So, what companies are examples of great corporate spin-offs?

Today I’m going to walk you through a few outstanding corporate spin offs: Ferrari, IDW Media, and Thungela Resources. Each of these produced very large returns for shareholders and could have been readily spotted in advance.

FCA Corporation Spins-off Ferrari

If you’ve been a resident of planet Earth for any length of time, you’ll probably know the name Ferrari.

In 2014, FCA announced that it would be spinning off the legendary brand as a stand-alone company. Sergio Marchionne had just taken over at FCA, and his goal was to start unlocking value for shareholders. Ferrari was buried under a mess of other automotive assets, and Marchionne figured that Ferrari would be better as an independent company. In the process, he could also raise some money for FCA.

Marchionne started by selling 10% of Ferrari in an IPO for $52 per share in October 2015. That immediately raised $893 million and valued the company at $9.8 billion. Two months later, he spun off FCA’s remaining 80% stake in the business to FCA shareholders.

At the time of the announcement, FCA was trading for a total market cap of $13.74 billion. While investors would not have known the exact value of Ferrari, they would have known based on the available data that the brand was worth a lot of money.

Ultimately, Ferrari turned out to be worth about 64% of FCA’s market value. FCA’s other assets included brands such as RAM, Jeep, Fiat, Chrysler, etc. In short, you were getting a lot of those brands at a severely discounted price, and that value was likely to be unlocked by Marchionne.

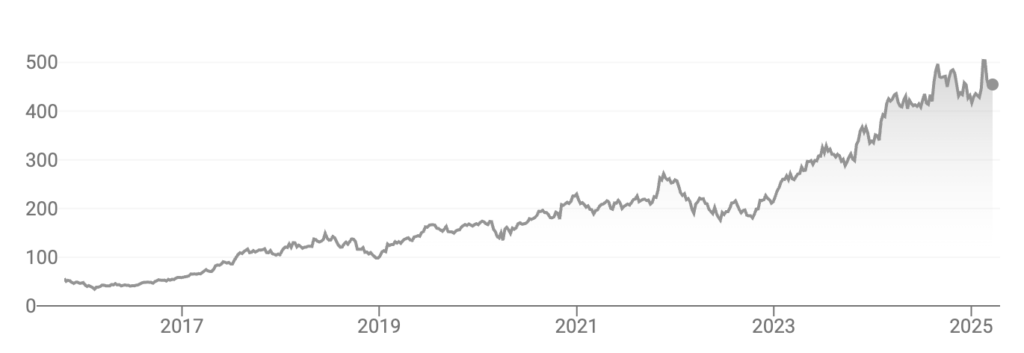

Shares dipped after the initial IPO as more stock came on the market. This depressed the price down from $56.38 to $38 per share by the end of February. At that price, shares were trading for about 25x earnings. This was a bit higher than the S&P 500, but the powerful franchise and legendary brand promised growth ahead.

But, more than just a pretty face, Ferrari was a very profitable company and had significant pricing power. The stock soared after being spun off from FCA as sales and earnings grew. One year post-spinoff, shares were trading above $60. Shares kept climbing as the company kept growing revenue and profits. Nine years later, shares stood at $485 each, for a total return of 766%, or 27% compounded over 9 years.

The Ferrari saga highlights what can happen when you stumble upon a collection of assets and a newly appointed CEO who has the intent of increasing shareholder value. If you can spot this sort of situation, you can make a huge amount of money when the CEO peels off key assets.

IDT Corporation Spin Off IDW Media Creates Massive Value

Howard Jonas, IDT Corporation founder and Chairman, was an entrepreneurial wizard. In the early 2000s, he turned his attention to venture capital – buying tiny upstart businesses with great management that he could incubate inside of IDT and then spin off to investors.

IDW Media was one of those businesses. In September 2009, Jonas decided it was time to spin the company off from IDT. The firm was on solid footing, led by good management, and it was growing.

IDW hit the market at $1.22 per share, with CEO Marc Knoller at the helm. Davidi Jonas, Howard’s son, would later call Marc a cash printing machine. Under his leadership, sales and profits quickly grew and the stock rose to a value of $41 just 6 years later. Shareholders earned a massive 32.6x gain since the shares were spun out – a huge 80% compound annual return.

The stock would actually climb a bit higher, hitting $53 in November 2016, but the part would end when the company turned its attention from comic books to creating content for Netflix – a hard business to be in.

Losses started to mount and soon the company would lose almost all of its value, hitting $0.30 per share after a revolving door of CEOs.

IDW Media is a good example of how explosive share price growth can be when a gifted businessman distributes a subsidiary with the intention of providing shareholders with value. It’s also a great example of what ultimately happens to businesses that lack a moat.

Corporate Spin Off Thungela Resources: An Example of an Outstanding Opportunity

I’ve saved the best for last. While Ferrari saw some pretty sweet gains, nothing that I know of compares to the outstanding spin-off that was Thungela Resources.

In 2021, Anglo decided to get rid of its coal mining operations for ESG reasons… coal not being friendly to the environment and all.

Anyone paying attention, though, could have seen that the company was going to make a huge amount of money for the next 12 months and that the price the company was to be spun out at was way too cheap.

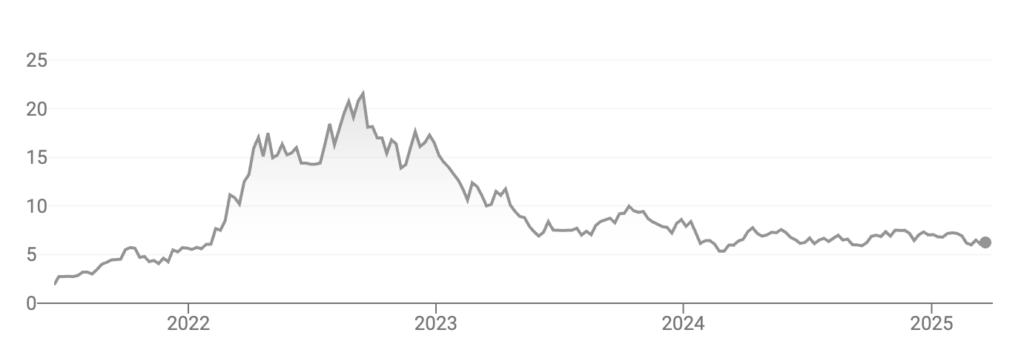

The plan was to spin the company out with an initial trading price of 150p per share. The spin off company was on target to earn 60p that year, however, and looked set to earn more for the following year.

That meant the company was trading at a forward PE of about 2x for 2021, and possibly much lower based on 2022 earnings.

Shares hit the market on June 16th, 2021, and immediately jumped 50% – a sign that shareholders had spotted the opportunity. Over the next 6 months, shares continued to climb, hitting 442p per share by the end of the year. That was a 195% gain in 6 months.

But shares continued to rocket through 2022, as the company’s growth in earnings materialized. By the end of that year, the company recorded a net income of 125p per share and the stock closed at 1208p, just off the company’s yearly high of 1823p.

Even if investors missed the peak, they had still achieved a 7x return in a year and a half. That amounted to a CAGR of about 450%.

Thungela Resources is a great example of how lucrative it can be when a spinoff creates a temporary dirt cheap valuation for an otherwise fine company. In investing, the price you pay often determines your returns.

How Do You Find Great Corporate Spin Off Opportunities?

To find great spin off opportunities, you really have to have a pulse on the market, understanding what’s happening on a daily or weekly basis. You need to dig through forum posts, news articles, forums, etc. It can be a lot of work.

Alternatively, you can monitor SEC filings to find out which companies are planning spinoffs, and then research the ones you find most promising.

But, a much easier way is to sign up for free special situation alerts as part of our free Morning Brew newsletter. Each day we scan the interwebs to identify newly announced special situations. We then send our subscribers a nicely packaged email listing the deals that we find.

Enter your email in the box below because you do not want to miss any more of these exceptional spinoffs.

Read Next: