A couple of years back a friend clued me in to an American businessman named Howard Jonas.

Jonas, he said, was an old school serial entrepreneur who went from a small hotdog stand as a kid to billionaire status all through founding new businesses.

Unlikely, I thought. After all, if someone had that kind of story they would be a household name, like Richard Branson.

But, I soon discovered that all of it was true, and even better, he had a couple of public companies that would prove extremely interesting to special situation investors.

Table of Contents

Howard Jonas: From Hotdogs to Billionaire

Like many other entrepreneurs, Howard S. Jonas started with a tiny business business as a kid – in his case selling hotdogs. After a run in with the local New York mob, Jonas found himself the only stand in the area and made a killing.

Over the course of college and into adulthood, Jonas would find a number of companies with varying degrees of success. But his life really took off when he founded IDT (International Discount Telecommunications). IDT’s mission was to lower the price of long distance calls and achieved this through call back technology (you call the US number outside the US, and they call you back automatically, so the US customer with the cheaper plan gets charged), and then later through VOIP software.

Growth, though, would soon drop off, and Jonas would turn to another approach to entrepreneurship that most of us would relate to – venture capital. Jonas would keep an eye out for tiny new firms with great ideas and people, buy majority stakes in those companies (new ventures are always short of cash), and then incubate them inside of IDT. When ready, he would spin them off to IDT shareholders.

Over the last 25 years, IDT has turned into a bit of a spinoff machine. The combination of IDT’s balance sheet, Howard Jonas’ business brilliance, and an emphasis on shareholder return would make IDT a true gem for special situation investors. In the process, Jonas would enter billionaire status and spin out a few kids, one of which – Davidi Jonas – would become a skilled businessman himself.

There’s a lot more to the story of this entrepreneur and businessperson than can be covered in this article, obviously. Luckily, Jonas has written most of it down for investors in his book, On a Roll.

IDT Corporation - From Idea to Spinoff Titan

Howard Jonas is the Chairman and Founder of IDT Corporation. Jonas founded IDT Corp. in 1990 when Jonas got sick of paying large international calling charges for his sales office in Israel. Always keen on lowering his risk, he convinced others to buy the telecom equipment and rent it to him rather than putting up the capital himself. This lowered his upfront investment, and investors could sell the equipment to recoup their investment if the business failed.

People misunderstand entrepreneurship. Most of the public think that founders are risk takers, making huge bets with enormous risks and rewards depending on how the bet plays out. Not true. The best founders find a way to limit the risk that they take when they start new ventures. All the bets that I have made in my life as an entrepreneur, for example, have been tiny and sought to gain traction before ramping up spending. And, this preference for minimizing risk comes into play with each of Howard Jonas' companies.

IDT Corporation didn’t fail. Sales were brisk, and the company made a name for itself in the early 1990s. Technology was changing, though, and soon voice over internet protocol would allow IDT to offer new better services. He launched Net2Phone in 1996, a voice over internet protocol (VOIP) service, which also turned into a hit, and sold 32% of the company to AT&T in 2000 for $1.1 billion.

It took a few years, but IDT shifted from just starting new businesses to purchasing or making big investments (in terms of ownership percentage) in tiny startup companies, and then incubating them. Jonas started in February 2006 with the re-acquisition of Net2Phone, the same company Jonas launched in 1996. At the end of the year, Jonas made his second purchase with Zedge.net, a mobile focused social media community. The following year, IDT Corporation acquired majority control of Idea and Design Works (IDW).

Buying a company that seems to have some traction is a much lower risk bet than founding a company, then dedicating all your time and effort to making that business a success. Jonas would make small bets in a company at first in terms of total funds invested and percentage ownership, but would insist on warrants so he could greatly increase his stake if the business started to work out. This is a low risk way to bet on situations with massive upside potential.

IDT Corporation Subsidiaries - Spinoffs That Creamed the Market

Soon investors began to understand Howard Jonas’ new strategy for IDT Corporation. Rather than just hang on to the companies he acquired, his game plan seemed to be incubating them and then spinning them off as standalone businesses when ready. Jonas was always ready to invest personal money into promising companies, but now he would grow them and then spin them off to live lives of their own.

Howard Jonas Spins off IDT Subsidiary IDW Media

IDW Media was Howard Jonas’ first spinoff. First acquired in 2007, Jonas decided to spin the company off from IDT Corporation in September 2009, but remained and still remains Chairman of the board since inception.

It was an interesting time to spin out a company. The US economy seemed to have exited the Great Financial Crisis, but there was still a lot of worry about a double dip recession. The NASDAQ had regained most of the pre-crisis high but it was not at all clear that a new bull market would start. The worst, though, seemed to be over.

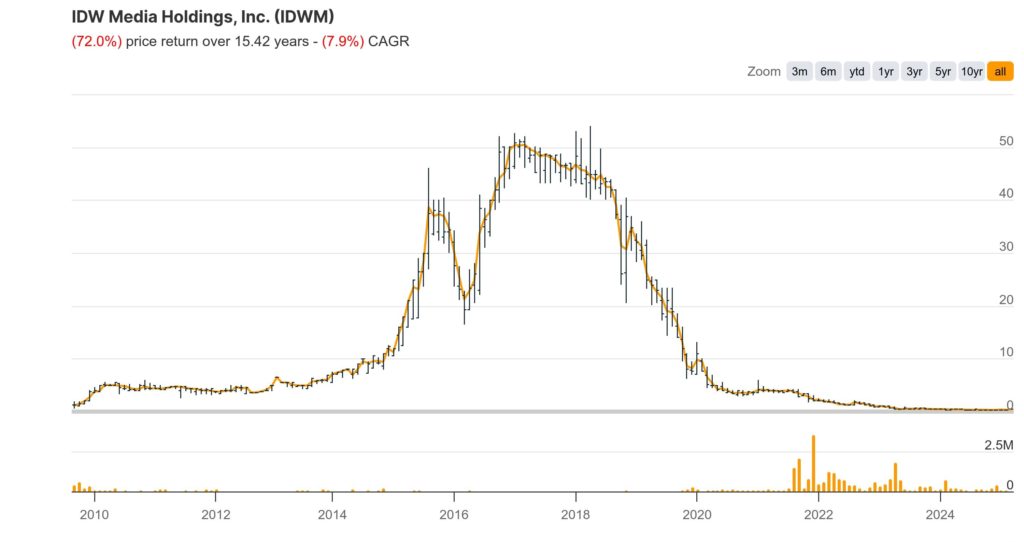

IDW Media (IDWM) went public at a price of $1.22, under the leadership of Marc Knoller as CEO. The idea was to split off IDW Media from IDT Corporation so that management could focus on executing its growth opportunities, and shareholders could receive a more accurate value for their holdings in the market. Howard Jonas’ son would describe CEO Knoller as a sharp businessman - a real money printer.

And grow it did. Sales doubled from $33 million per year in 2009 to $65 million per year by 2016, and net income increased from $1.6 million to $6.14 million over the same period. This was enough to push the stock up to $44 by the end of 2016 and reach a high of about $50 in early 2017. Shareholders who hung on from the spinoff date saw their shares increase a whopping 4,000% over 7 years. Price growth of that rate turns $10,000 into $413,115 - enough to buy a nice house in Texas.

Sadly, the good times didn’t last. By 2015, CEO Marc Knoller had left the company, and IDWM Media took an unfortunate entry into the film space which did not pan out as expected. The company began bleeding red a couple of years later, followed by ongoing losses and a revolving door of leadership over the next ten years.

The tide seemed to change in 2024, however, after Davidi Jonas - Howard Jonas’ son - took over the CEO position. He quickly moved to stem the losses by (in a very Icahn-like move) firing 40% of the staff and ending money-losing projects. The company seemed to stabilize and would produce a token profit later that year.

Davidi and his father Howard Jonas later invested their own personal capital into the company - a strong sign of faith that the company could turn around. Trading below liquidation value and having new bold leadership, the stock was finally an attractive turnaround opportunity.

Howard Jonas Spins off IDT Corp. Subsidiary Genie Energy

Howard Jonas formed IDT Entergy under IDT Corporation in 2004 with the goal of producing oil in Israel. Jonas spun out the subsidiary as Genie Energy in October 2011 at a price of $9.14 per share. In classic spinoff stock behaviour, shares dropped to $6.85 a month later, before rebounding to $10.75 two months later.

At that price, shareholders were getting a company that was just breaking even, and paying double book value for the firm. Genie owned a 50% interest in American Shale Oil, LLC of Colorado, IDT Energy, an energy services company that resells electricity and natural gas to residential and small business customers in New York, New Jersey, and Pennsylvania, and an 89% interest in Israel Energy Initiatives, Ltd., an oil shale initiative in Israel. Investors had 3 paths to profits, as any of these holdings could have proved to be good growers and really move revenue & earnings. And, the company may have proved to be a bargain at $10.75 per share if the company could strike black gold in Israel, but that was not at all certain.

Sadly, none of these bets seem to have turned into growth machines, with shares trading at just $14.78 14 years later. Genie Energy has been a real disappointment for shareholders who hung on since the spinoff.

Straight Path - Howard Jonas’ Greatest Spinoff

Straightpath Communications is the sort of scenario that spinoff investors dream of. Ironically, it also turned into a black mark on Howard Jonas’ otherwise good reputation. More on that later.

In the wake of the Dotcom bust, Jonas went deep value fishing for assets and managed to scoop up a bunch of wireless spectrum licenses for about $50 million from Windstar Communications after it filed for bankruptcy. This was a spectrum that nobody saw a contemporary use for or wanted, and that he could slip into IDT’s balance sheet for next to nothing. Jonas figured that the 5G wireless licenses would prove useful and far more valuable at some point in the future, though.

Around 2010, Jonas placed his son, Davidi Jonas, who had trained and practiced as a Rabbi prior to joining IDT, in the CEO position of IDT’s wireless division at the age of 26. The division had been losing money for 5 or 6 years prior to Davidi Jonas taking over, and it was Davidi’s job to see if he couldn’t make something of the business.

In 2013, Howard Jonas decided to spin out that division – essentially a collection of assets and telecom tech – under the name Straight Path Communications. Among those assets was the wireless spectrum that Jonas had picked up years earlier for next to nothing. The division went public in July 2013 at $6 per share, valuing the firm at a tiny $25 million.

Despite continued losses, telecom providers soon began to take notice of the firm’s treasure trove of assets. Both AT&T and Verizon began to make offers for the company, and the firm was eventually sold to Verizon for $3.1 billion dollars, about $184 per share.

The sale price was quite a jump from the $6 the firm went public for. The 30.7x gain investors enjoyed since the spinoff would have turned $10,000 into $307,000 in just 4 years. If we are talking about spinoffs that ended well, Straight Path was by far Howard Jonas’ greatest.

Zedge - Howard Jonas’ Plan to Monetize This IDT Subsidiary’s Massive Userbase

Zedge was founded in 2003 as a mobile-focused social media community, and just three years later Howard Jonas had IDT purchase a majority stake in the company.

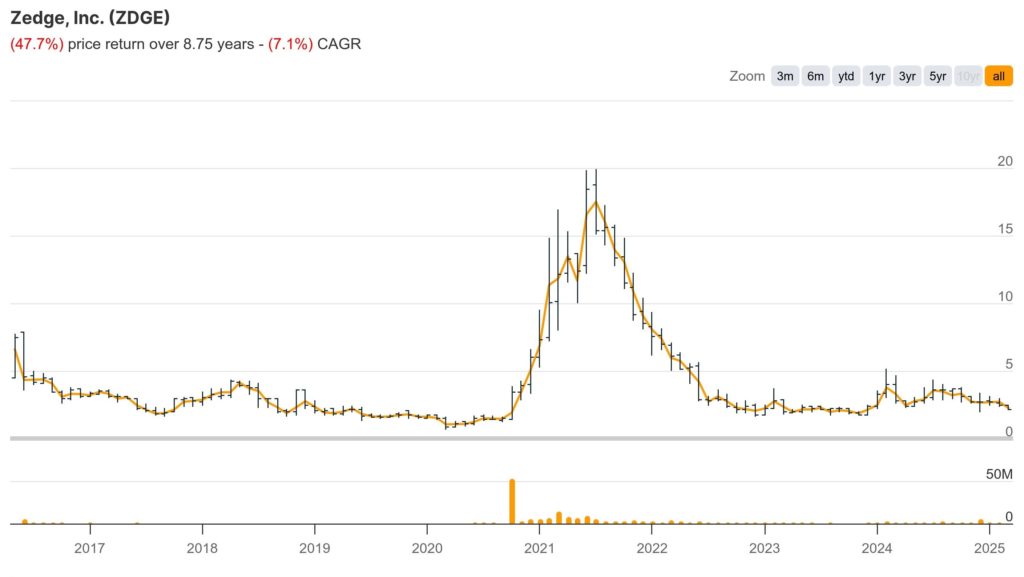

IDT spun off Zedge in 2016 as a wallpaper and ringtone app. This was a shift away from the focus of the company when Jonas originally bought the firm, but all great entrepreneurs pivot until they find some offer that gains traction. The company went public at $7.10 per share but immediately dropped to $4.30 – an exceptional decline for a spin off in just a week. Unlike the typical dip and pop that you get with most spin offs, Zedge’s stock price remained depressed in the mid-$4 range for the next 4 months.

Despite the stock decline, Zedge was far from a broken company. It was recording profits of $1 million on revenue of about $11 million and boasted 32 million active monthly users. This was a huge number of monthly users, and certainly a group that the company could further monetize somehow in the future.

A year later, Zedge purchased Freeform Development for cash and stock, acquiring IP and the company’s management in the process. One of those managers was Tim Quirk. Quirk had an interesting background - he had been involved with MySpace during its early years and was one of the first people hired by Google to build out the Android store, and later promoted to Vice President of Digital Content. The plan with Zedge was to create a marketplace called Zedge Premium to monetize Zedge’s huge user base by allowing creators to sell their art to app users.

The team got to work building out the platform, but the added R&D costs pushed the company into losses. Losses grew over the next couple of years, and the stock sank. By March 2020, near the depth of the Covid crash, shares hit $0.80 – an 89% decline from the spinoff high of $7.10 – but the firm still had $3.65 million in net current asset value, with plenty of cash and virtually no debt. More importantly, work on the platform was nearly finished.

Revenue surged with the launch of the new platform. Sales hit $19.6 million for 2021, up 104% from the previous year’s $9.6 million. Net profit also took off, hitting a massive $8 million, as more and more people adopted the premium offerings. Sales increased another 36% for 2022, and the company was bringing in $11.6 million in net profit. This amount was more than the company ever earned in revenue, let alone profit.

The share price exploded. From 2020’s $0.80 low, the stock shot up to $18.10 in just 15 months. While shareholders who had hung on since the spinoff were finally vindicated with a 155% return over 5 years, anybody who bought below $1 in the dark days of 2020 saw a massive 18x return. That’s enough to turn $10,000 into $180,000 in just a year.

The Good times for shareholders, however, would not last. While the company continued to grow revenue - albeit very slowly - management launched a new app named Shorts which offered app users stories via text. R&D ramped up again, completely erasing profits.

While it remains to be seen just how well Zedge can continue to monetize its massive user base, this story is a lesson in how valuable a user base can be with regards to future growth.

Rafael Holdings - An IDT Subsidiary Spinoff That Became an iDT corporate clone

Cornerstone Pharmaceuticals was formed in 2001 by a coalition of doctors who wanted to develop an alternative treatment for cancer, known as cancer metabolism, which was a far less toxic way to treat the disease.

Howard Jonas met the CEO of Cornerstone Pharma through Howard’s son in the early 2010s and was impressed with the work they were doing. He decided to help the company out so joined their board. By 2012 the firm was starting to run out of cash, putting its cancer drug development in jeopardy, so Jonas offered to fund the company for a mix of cash and warrants.

Jonas spun out the company in March 2018, as a mix of real estate, cash, its Cornerstone holding, and other odds and ends, at a price of $4.85 per share. At that price, the company was trading for about the value of its real estate, with all other assets thrown in for free. The stock doubled within 2 months and held a value between $8 and $9 for the rest of the year.

Trials soon began on the company’s cancer drug and the stock rose from the mid-8s to a high of $62.74 per share in July 2021 as the phase 3 trial unfolded. In September of that year, the FDA granted the company a fast track designation to speed up the time it would take to bring the drug to market after a successful phase 3 trial.

But in October, Rafael announced something the market already knew - it had failed its phase 3 trial. The stock was already down -76% anticipating the news, but the shock sent shares down to $2 just 7 months later. In the meantime, Rafael had ended all trials related to the drug and raised cash by selling stock before full share price annihilation took place.

This was a brutal scenario for investors who bought based on phase 3 hype in 2021. Shareholders who bought at $60 ended up losing 97% of their investment. This is a strong reminder that it’s usually best to avoid enthusiasm and to try to scoop up promising companies for far less than they’re worth based on today’s figures.

If there’s one thing we can say about Howard Jonas, however, it’s that he doesn’t give up. By wisely raising cash after the disastrous phase 3 announcement, ending the company’s drug development, and selling off a significant amount of real estate, Jonas provided himself with a war chest that he could use to do what he does best – identify, buy, and incubate interesting firms that he can spin off to shareholders.

At the time of writing, Rafael has entered into a merger agreement with Cyclo Therapeutics, currently in a phase 3 trial for a promising orphan drug that was previously used on compassionate grounds. Research indicates that phase three drugs that were previously used on compassionate grounds have about a 65-80% chance of getting FDA marketing approval – the approval needed to bring the drug to market. And, unlike with Rafael’s cancer bet, there’s no investor enthusiasm over this one so the company trades just about at liquidation value.

While anything can happen going forward, it’s hard to argue that Rafael is not an interesting set up. Even if the phase 3 trial fails, the firm should have about $1.60 in liquidation value, a couple of smaller divisions, and Jonas should have a lot more cracks at bat left.

Howard Jonas Controversy

Despite Howard Jonas’ wildly successful career as an American entrepreneur and businessman, he’s not without his controversies.

The first dates way back to the early 2000s when he picked up wireless spectrum licences in bankruptcy. Regulators don’t like companies buying up scarce spectrum and sitting on it instead of using it to offer new services to the public. One condition of buying the spectrum was apparently that Jonas would deploy the spectrum in one of his businesses.

When Jonas spun out Straight Path, IDT Corp. provided the new firm with indemnification for certain liabilities that they may have incurred through prior business activities. Shortly after, the FCC came down on Jonas with a $100 million fine issued to Straight Path and the need for the company to pay 20% from any sale of the licenses to the FCC for hoarding spectrum.

Leading up to the Verizon sale, a special committee was formed at Straight Path with the aim of negotiating to preserve the indemnity agreement. But, Jonas was both IDT’s and Straight Path’s majority shareholder and allegedly intervened by pressuring the board and threatening to derail the deal if Straight Path pursued the claim against IDT. He even allegedly called the board “bullshit directors” (a term that I can relate to as a long time minority shareholder), which later came out in a court filing.

With a sale price of $3.1 billion, the 20% that IDT would be stuck with would have amounted to about $620 million – but some estimated the value at up to $1.2 billion – a direct hit to Howard Jonas’ net worth as majority owner of IDT Corporation and possibly putting the future of the company at risk.

As a result of the pressure he allegedly inflicted on the board of directors, they agreed to settle the claim for just $10 million and sold telecom assets to IDT for $6 million – an amount some shareholders claimed was far too little.

It’s easy to see the unethical behaviour here, but it’s also easy to relate to Howard Jonas’ actions since they put much of his life’s work at risk.

In the end, the then CEO Davidi Jonas settled out of court for $12.5 million, and – despite breaching his fiduciary duties – the court found that shareholders were not financially harmed and the deal was considered fair overall, so the court awarded nominal penalties to Howard Jonas for the breach.

More recently, Howard Jonas has been in trouble with the SEC for failing to declare stakes in various companies in a timely manner. While not ideal, I chalk this up to a slip in accounting rather than a failure of moral character.

Why Special Situation Investors Should Pay Attention to Howard Jonas and IDT Corporation

Howard Jonas is a visionary American businessperson and entrepreneur. He basically invented the callback industry – which proved a big winner – and created VOIP telecommunications. Those two accomplishments alone are enough to warrant monitoring what he’s up to now.

But, if you take a deep dive into Jonas’ career as I have, one thing becomes clear: Howard Jonas is a gifted entrepreneur with a great track record of spotting opportunity and capitalizing on it. Whether selling hot dogs, mail order Christmas trees, newsletters, or long distance calling, Jonas has proven himself not only to be a serial entrepreneur but also a serial winner.

In the second phase of his career, he shifted from doing much of the hard work of starting businesses himself to identifying promising ideas and people, then making strategic investments into those companies, incubating them, and spinning them out later for shareholders.

While the companies he’s spun out have not proven to be Buffett-like compounders, they definitely exhibit a lot of sparkle in the market and can make fortunes for investors who purchase cheaply and get out when valuations seem to be at nosebleed levels.

I spend a lot of my time scanning firms like IDT or Rafael Holdings – firms run by gifted managers with a tendency to execute special situation events – for opportunities.

I highly recommend requesting free access to all of the special situations we identify each and every month by entering your email into the box below because you don’t want to miss one of these rare special situation opportunities.

Read Next: