Curious about special situations investing and the dynamics of short squeezes? How long does a short squeeze last? Explore our guide. What are the risks and rewards involved?

How Long Does a Short Squeeze Last?

A short squeeze usually lasts two to four weeks, but it can be shorter or longer depending on factors like the volume of shorted shares, the short interest ratio, and the average daily trading volume. The duration can also be influenced by broker actions regarding the borrowed shares.

What is Short Selling?

Short selling is a trading strategy where an investor borrows shares of a stock they believe will decline in price. The investor then sells these borrowed shares on the open market. If the stock price falls as anticipated, the investor buys back the shares at a lower price and returns them to the lender, pocketing the difference. However, if the stock price rises, the investor faces potentially unlimited losses, as they must buy back the shares at a higher price. What is a short squeeze and its benefits and risks?

What Exactly is a Short Squeeze?

A short squeeze is a special event characterized by short sellers rushing to cover their short bet on a stock en masse, resulting in a stock price spike. A short squeeze typically occurs when a stock with a high level of short interest, many investors betting against the stock, experiences a rapid increase in price. This forces short sellers to buy shares to cover their positions, further driving up the price.

Benefits of Looking For Short Squeeze Candidates

Investors who hold long positions can benefit from the rapid increase in stock price, creating significant profit opportunities. High-profile short squeezes can draw attention to specific stocks or sectors, potentially leading to further investment interest. It also offers savvy traders the chance to capitalize on price movements.

Risks Inherent in This Event Driven Strategy

If you plan to look for short squeeze candidates, you need to be careful of a couple of things. First, short sellers tend to be sophisticated investors, so you are likely betting against smart practitioners by going long.

Secondly, the short sellers could be correct and the stock could be going much lower. If the squeeze does not happen, losses are likely.

Third, if you buy into a squeeze that’s just starting, it may fizzle out, leading to a lower stock price and losses. The stock price can become extremely volatile, making it unpredictable and risky for all investors. You need to know when to exit.

Short sellers face significant risks as well. A short squeeze causes short sellers to suffer losses as they are forced to buy back shares at higher prices, leading to potential financial strain. Remember, losses due to shorting can be very large and lead to bankruptcy.

How do you know if a short squeeze is happening?

The key indicators that signal a short squeeze is happening are high short interest, rapid price increase, increased trading volume, elevated borrowing costs, and the presence of a positive catalyst. Here are the details:

High Short Interest

High Short Interest refers to a large percentage of a company's shares being sold short. This metric indicates that many investors are betting against the stock, expecting its price to decline. A high short interest ratio, short interest as a percentage of the stock's float, signals the potential for a short squeeze, as there are many short positions that could be forced to cover if the stock's price rises.

Rapid Price Increase

A rapid price increase in the stock is a telltale sign of a potential short squeeze. When the stock price starts to rise unexpectedly, short sellers may begin to panic and buy shares to cover their positions, driving the price even higher. This creates a feeder loop where the increasing price forces more short sellers to cover, further accelerating the price rise.

Increased Trading Volume

Increased trading volume is another key indicator of a short squeeze. As the stock price rises, the trading volume typically surges, reflecting the activity of short sellers covering their positions and new investors jumping in to take advantage of the upward momentum. This heightened trading activity can lead to significant price fluctuations.

Borrowing Costs

Rising borrowing costs for short sellers can signal a short squeeze. When it becomes more expensive to borrow shares for shorting, it indicates that there is a high demand for those shares, and fewer are available to borrow. This can force short sellers to close their positions sooner rather than later, contributing to the squeeze.

Positive Catalysts

Positive catalysts such as unexpected, good news, earnings beats, product launches, or favorable regulatory decisions can trigger a short squeeze. When the stock experiences a positive catalyst, it can lead to a sharp increase in demand for the shares, causing the stock price to rise rapidly and prompting short sellers to cover their positions.

How long does a short squeeze last? The duration is typically two to four weeks with a chance of lasting longer based on extenuating circumstances. Understanding these indicators can help you identify a short squeeze and make informed decisions.

What is the Biggest Short Squeeze in History?

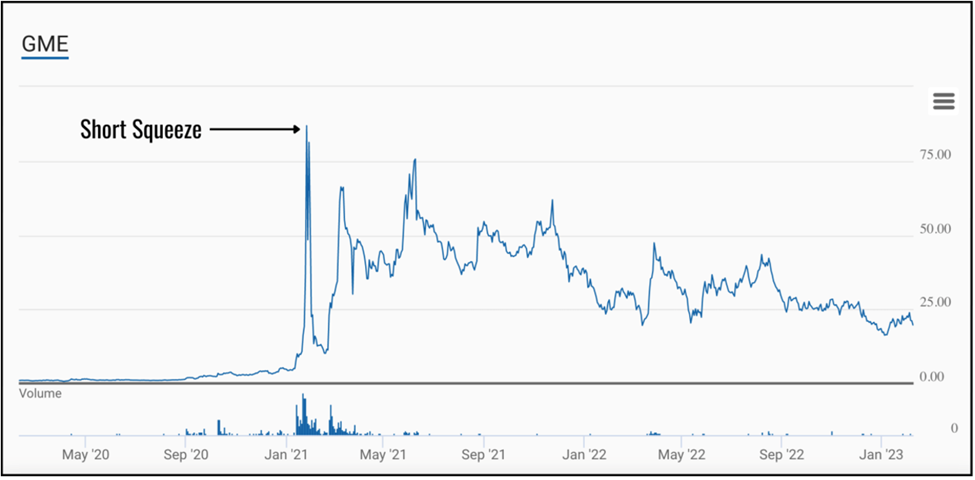

The GameStop (GME) short squeeze in early 2021 is considered the biggest short squeeze in history. This event was driven by retail investors on forums like Reddit's WallStreetBets, who banded together to buy up GameStop shares. Their collective actions caused the stock price to skyrocket, forcing short sellers to cover their positions at huge losses. Overall, the stock price surged by over 4,000%, leading to significant financial strain for hedge funds that had bet against the stock.

The GameStop short squeeze not only highlighted the power of collective retail trading but also drew regulatory scrutiny and sparked debates about market manipulation. The role of social media in influencing stock prices came under the spotlight. It was a remarkable moment in financial history that captured global attention.

How Long Did the GameStop Short Squeeze Last?

The GameStop short squeeze lasted five weeks. The short squeeze started to gain traction in early January 2021. Retail investors on Reddit's WallStreetBets noticed that GameStop had a high short interest and started buying shares and options to push the stock price up.

The stock price began its sharp ascent around January 22, 2021, and the most intense phase of the short squeeze occurred between January 25 and January 29, during which the stock price soared on January 28. This rapid increase caused significant financial strain for hedge funds and other investors who had heavily shorted the stock, as they were forced to cover their short positions at much higher prices.

After reaching its peak, the stock price experienced high volatility, with dramatic swings in both directions. Throughout February 2021, the stock continued to trade at elevated levels, maintaining significant interest from both retail and institutional investors. By the end of February, the stock had settled somewhat, but it remained higher than its pre-squeeze levels.

How long does a short squeeze last? A short squeeze can last anywhere from a few days to a few weeks, depending on factors such as the volume of shorted shares and the buying pressure from investors. The duration can vary widely based on market conditions and the specific circumstances surrounding the stock.

How High Can a Short Squeeze Go?

The stock price during a short squeeze has unlimited potential to increase due to a combination of factors:

1. High Short Interest: When a significant percentage of a company's shares are sold short, there's substantial pressure on short sellers to cover their positions as the stock price rises. This means they must buy back the shares they borrowed and sold, adding to the buying pressure and driving the price up.

2. Limited Supply: The stock's float, the number of shares available for trading, can limit how many shares can be bought back quickly. When there's a high demand to cover short positions but a limited supply of shares, prices can surge to very high levels as short sellers scramble to buy back shares at almost any cost.

3. Buying Frenzy: The initial price increase often attracts other investors who hope to profit from the rising prices. This can include retail investors, institutional investors, and even algorithms that detect upward momentum. The influx of new buyers adds to the overall demand, pushing the price even higher.

4. Positive News and Catalysts: Any positive news about the company, such as better-than-expected earnings, new product launches, or strategic partnerships, can further fuel the buying frenzy. This news could change the market's perception of the company's value, leading to even more buying pressure.

5. Psychological Impact: As the stock price climbs, the psychological impact on investors and traders can be significant. Fear of missing out (FOMO) can cause more people to buy into the rally, while fear of losing even more money can force short sellers to cover their positions quickly, regardless of the cost.

GameStop serves as an example of how high a short squeeze can go. In early 2021, the stock price surged from around $65 to an intraday high of $483 within a week, representing a gain of over 600%. Such dramatic increases are rare but demonstrate that there is no theoretical upper limit to how high prices can go during a short squeeze.

How long does a short squeeze last? The length of a short squeeze can vary, but it usually lasts between two to four weeks. The duration depends on how quickly short sellers cover their positions and the level of buying interest from other investors. Some short squeezes may resolve faster, while others can extend for a longer period.

Read Next: