Merger arbitrage, or M&A arbitrage, is a strategic investment approach that leverages price differences during mergers and acquisitions. By purchasing shares of the target company and betting on the deal's successful closure, investors aim to capture the spread between the current market price and the acquisition price.

This strategy is not without its challenges, namely, regulatory hurdles, deal collapses, or extended timelines that can impact profitability. With risks tied to market uncertainties, how can investors identify opportunities that balance potential rewards against inherent risks?

This concise guide explores the mechanics, opportunities, and complexities of merger arbitrage in today’s financial landscape.

Table of Contents

Your Complete Guide to Merger Arbitrage

Merger arbitrage is an investment strategy that capitalizes on price gaps between a target company’s stock and its acquisition price during mergers and acquisitions. By buying the target's stock at a discount and profiting from spread convergence as the deal finalizes, investors can achieve steady returns, provided the transaction closes successfully.

This strategy is popular among hedge funds and institutional investors due to its potential for stable, risk-adjusted returns. However, it comes with challenges, including regulatory approvals, shareholder consent, and market conditions that may disrupt deals, necessitating thorough due diligence and risk management.

Merger arbitrage opportunities arise from diverse M&A scenarios, such as friendly takeovers, hostile bids, leveraged buyouts, or strategic acquisitions. Each presents unique risks and rewards, requiring investors to adapt strategies to maximize gains while mitigating uncertainties.

By understanding the intricacies of merger arbitrage and staying informed about the latest developments in the M&A landscape, investors can position themselves to capitalize on this lucrative investment strategy. Let’s add some context:

What is Merger Arbitrage?

Merger arb seems simple at first, but deals can get pretty involved. But before touching on those, we need to lay the foundation. What’s merger arb?

Definition and Overview of Merger Arbitrage

Merger arbitrage is an investment strategy that profits from price differences during mergers and acquisitions by buying the target company’s stock below the acquisition offer, anticipating price convergence as the transaction nears closure.

This approach involves analyzing deal terms, regulatory conditions, and potential hurdles to evaluate the probability of completion, reducing exposure to broader market volatility. While it offers consistent returns, the strategy requires meticulous research and precise execution to navigate challenges effectively.

Now, to find merger arbitrage deals quickly and easily, make sure you enter your name in the opinion box below because we’ll send you each and every deal we find each month in a nicely packaged email.

Historical Context and Emergence of Arbitrage Strategy

Merger arbitrage, rooted in the broader concept of arbitrage that dates back centuries, gained prominence in the early 20th century as mergers and acquisitions became key growth strategies. By the late 20th century, hedge funds and institutional investors refined the strategy with advanced models, while modern technology and data analytics further enhanced due diligence and risk assessment.

Key Characteristics of Merger Arbitrage:

- Price Discrepancies - Merger arbitrage opportunities arise from the difference between the target company's current stock price and the acquisition price offered by the acquirer. This price discrepancy, or spread, is the primary source of profit for arbitrageurs.

- Risk and Uncertainty - While the potential for profit is significant, merger arbitrage involves risks related to the transaction’s completion. Factors such as shareholder consent, market conditions, and regulatory approval can impact the likelihood of the merger being finalized.

- Event-Driven - Merger arbitrage is an event-driven strategy, meaning that investment decisions are based on specific corporate events. This focus on event-driven opportunities differentiates merger arbitrage from other investment strategies.

- Expertise and Analysis - Successful merger arbitrage requires a deep understanding of M&A transactions, legal and regulatory frameworks, and market dynamics. Investors must conduct thorough due diligence, assess the probability of deal completion, and monitor developments closely.

Understanding what m&a arbitrage entails provides a foundation for exploring its practical application. Let’s delve into the mechanics of merger arbitrage to see how this strategy is executed in real-world scenarios.

The Mechanics of Merger Arbitrage

This analysis will delve into the mechanics of merger arbitrage by focusing on three essential elements: identifying mergers and acquisition targets, calculating arbitrage spreads and expected returns, and employing derivatives to execute arbitrage strategies effectively.

Identifying Potential Mergers and Acquisition Targets

Successful merger arbitrage hinges on identifying targets through corporate news, filings, and industry trends, followed by rigorous due diligence on financials, market position, and deal viability. Investors prioritize opportunities with favorable risk/reward profiles, focusing on transaction structure, regulatory hurdles, and similar past transactions to optimize strategies.

Calculating Arbitrage Spreads and Potential Returns

After identifying a target, investors calculate the arbitrage spread— the difference between the target's market price and the acquirer's offer. Adjustments for fees, timelines, and volatility refine this measure, forming a baseline for potential profit.

To evaluate risks, models estimate deal completion probabilities, using metrics like Internal Rate of Return (IRR). This process adjusts for contingencies, turning the visible spread into a realistic, risk-adjusted return, aligning with broader investment strategies.

Implementing Arbitrage Strategies through Derivatives

Derivatives play a key role in merger arbitrage by providing flexibility, risk management, and capital efficiency. Instruments like options and credit and interest rate swaps help hedge against potential losses, such as declines in an acquirer’s stock, while enabling leveraged exposure with minimal capital. This integration enhances profit potential, preserves a diversified risk profile, and strengthens strategies to navigate deal uncertainties, aligning opportunities with tangible returns.

Merger Arbitrage Strategies

Let’s cover four key merger arbitrage strategies: covered-call arbitrage, protective put arbitrage, collar arbitrage, and spread arbitrage. Do you believe these approaches sufficiently mitigate the unique risks inherent in merger transactions, or might there be additional measures worth considering?

Covered-Call Arbitrage - In a covered-call arbitrage strategy, an investor holding a long position in a target company's stock writes (sells) call options during a pending merger, generating premium income that reduces the cost basis and enhances potential returns. This income offsets market volatility, offering a cushion if the merger fails or the stock price remains stagnant. Particularly effective when the spread is modest, this strategy adds incremental profit while preserving the core merger arbitrage position.

Protective Put Arbitrage - Protective put arbitrage involves buying put options on a target company's stock to limit losses if a merger fails. The cost of these puts acts as insurance, balancing against the merger spread to provide a risk-adjusted return. This strategy is particularly useful in volatile market conditions or uncertain regulatory environments, effectively hedging against significant price declines in the target’s stock.

Collar Arbitrage - A collar arbitrage strategy involves writing (selling) call options and purchasing put options on a target security, creating a price collar that limits both upside and downside movements. This approach locks in predictable returns by capturing the merger spread while mitigating risk. The call premium offsets put costs, making this strategy ideal for investors seeking controlled exposure without the volatility of unexpected price swings.

Spread Arbitrage - Spread arbitrage capitalizes on the difference between a target stock's market price and its anticipated acquisition price, factoring in costs, timelines, and deal risks. Investors typically go long on the target stock and may short the acquirer to hedge, aiming for profits as the spread narrows closer to deal completion.

Success requires a thorough analysis of raw spreads versus transaction risks, dynamic adjustments to market conditions, and careful modeling to mitigate uncertainties and optimize returns. This strategy's effectiveness hinges on balancing potential rewards with the inherent risks of deal failure or delays.

An effective merger & acquisition strategy paves the way for unlocking value in these intricate transactions. Let’s now explore the benefits of merger arbitrage and how it leverages such strategies to achieve financial gains.

Benefits of Merger Arbitrage

The key benefits of merger arbitrage are limited downside risk compared to pure equity investments, the potential for significant gains with modest capital commitments, and the range of arbitrage strategies available to tailor investments to individual risk profiles.

Limited Downside Risk Compared to Pure Equity Investment

Merger arbitrage offers limited downside risk compared to equity investments, with losses mostly confined to the spread between trading price and breakup value. Its event-driven nature reduces exposure to market volatility while comprehensive analysis and hedging further risks. This predictability makes it an appealing defensive strategy in uncertain markets.

Potential for Significant Gains with Limited Capital Commitment

Merger arbitrage offers significant gains with modest capital commitments, leveraging the spread between acquisition and stock prices. When deals close, returns are amplified by the calculated spread's low-risk nature.

Tools like leverage and derivatives further boost returns, with profits tied to price spread convergence instead of market performance, making this a highly efficient and attractive strategy.

Diversity of Arbitrage Strategies Allows Customization to Individual Risk Profiles

Merger arbitrage incorporates strategies like covered calls, protective puts, collars, and spread arbitrage, allowing investors to adapt to deal specifics and market conditions based on their risk tolerance. By utilizing derivatives and hedging techniques, investors can balance risk and reward, optimizing returns while tailoring portfolios to suit individual objectives, making it a valuable component of diversified investment strategies.

What is merger arbitrage? While the benefits of this strategy can be compelling, it’s equally important to understand the challenges and risks that come with navigating such complex financial transactions.

Challenges and Risks of Merger Arbitrage

Let’s discuss the challenges and risks of merger arbitrage, focusing on market inefficiencies and liquidity constraints, regulatory uncertainties and potential legal issues, and the effects of bid-ask spreads and transaction costs.

Market Inefficiencies and Liquidity Constraints

Market inefficiencies in merger arbitrage stem from stock mispricing due to investor sentiment or delayed information, causing discrepancies in deal completion probabilities. Liquidity constraints, often tied to thinly traded securities, further complicating trades, leading to price fluctuations and execution delays. Investors must conduct deep analysis, prepare for slippage, and align trade sizes with market conditions to navigate these challenges effectively.

Regulatory Uncertainties and Potential Legal Issues

Regulatory uncertainties in merger arbitrage pose significant risks, as approvals from governmental bodies and shifts in antitrust policies can delay or derail transactions, disrupting timely returns.

Legal challenges from stakeholders further complicate matters, leading to costly litigation and delays that erode merger spread advantages. Thorough due diligence and continuous monitoring of regulatory and legal developments are crucial to managing these risks effectively.

Bid-Ask Spreads and Transaction Costs

Wide bid-ask spreads and high transaction costs can erode gains in merger arbitrage, particularly when spreads between the target stock price and acquisition price are already tight. Large bid-ask spreads reduce profit margins, while frequent trading in less liquid markets adds commissions and fees, further cutting into returns. Effective cost management and disciplined trading are crucial to maintaining an attractive risk-reward profile in these strategies.

Navigating the challenges and risks of merger arb is crucial for understanding its complexities. Next, we explore how merger arb investing offers unique opportunities for those willing to embrace these intricacies.

Merger Arbitrage Investing

This section delves into merger arbitrage investing, covering everything from its fundamental mechanics and key strategies to the benefits it offers and the challenges it presents in practice.

Introduction to Merger Arbitrage Investing

Merger arbitrage is an event-driven investment strategy that seeks to capture the price differential between a target company's current market price and its announced acquisition price. This special form of arbitrage occurs when a merger or acquisition is announced, creating an opportunity for investors to profit from the anticipated convergence of the target’s share price to the deal price at closing.

Investors using this strategy are not making a directional bet on the long-term prospects of the target company but rather on the likelihood that the deal will close as expected. By focusing on the specific trade setup, merger arbitrage can offer a risk-adjusted return profile that is distinct from broader market movements.

Fundamentals of Merger Arbitrage

Merger arbitrage involves buying a target company’s stock at a discount to the acquisition offer, profiting as the spread narrows when the transaction closes. Investors assess the deal’s structure and analyze factors like regulatory hurdles, market conditions, and stakeholder objections to estimate the likelihood of completion and calculate risk-adjusted returns.

Identifying Potential Merger Opportunities

The first step in merger arbitrage is identifying potential acquisition targets by monitoring corporate announcements, press releases, and regulatory filings. Investors conduct thorough due diligence, evaluating the merger's strategic fit, management track records, and historical success rates to uncover opportunities with the best risk-adjusted returns before widespread market recognition.

Calculating Arbitrage Spreads and Potential Returns

Once an opportunity is identified, investors calculate the arbitrage spread, the difference between the target's trading price and the announced acquisition price, representing the raw profit potential. This is refined by factoring in deal completion timelines, transaction costs, and the risk of failure or delay. Advanced models, such as ROR and IRR, assess probabilities of outcomes, allowing investors to compare the merger arbitrage's attractiveness against other investments and determine if the spread justifies the risks.

Implementing Arbitrage Strategies

A variety of arbitrage strategies can be employed to capture merger spread opportunities, allowing investors to tailor trades to their risk tolerance. Common tactics include:

- Covered-Call Arbitrage: Investors hold the target stock while selling call options to generate premium income, thus reducing overall risk.

- Protective Put Arbitrage: To hedge against adverse price movements if the deal falls through, investors purchase put options on the target.

- Collar Arbitrage: By combining the sale of calls with the purchase of puts, investors create a “collar” that limits both upside and downside potential.

- Spread Arbitrage: This straightforward strategy focuses purely on capturing the convergence of the spread between the current and acquisition prices.

Each strategy has its own risk-reward profile and capital implications, offering a toolbox for customizing the approach based on market conditions and individual investment objectives.

Benefits of Merger Arbitrage Investing

Merger arbitrage combines limited downside risk, capped by the transaction's breakup value, with the potential for significant gains using modest capital. By targeting price convergence between the target’s share price and the offer price, it offers attractive risk-adjusted returns. Diverse strategies enable tailored risk management, aligning positions with market conditions for optimized outcomes.

Challenges and Risks of Merger Arbitrage Investing

Merger arbitrage, while potentially rewarding, comes with challenges such as market inefficiencies, liquidity constraints, regulatory uncertainties, and legal risks, all of which can hinder timely execution and erode profits. Success relies on thorough analysis, precise spread calculations, and tailored strategies to achieve risk-adjusted returns that are less tied to market trends, underscoring the need for rigorous due diligence and proactive risk management.

Let’s move to merger arbitrage explained, where we break down the key elements of acquisition arbitrage concisely.

Merger Arbitrage Explained

This overview dives into merger arbitrage investing by outlining its core principles, methods for identifying and capitalizing on merger spreads, strategic implementations via derivatives, and the inherent benefits and challenges of the practice.

Definition and Overview

Merger arbitrage is an event-driven strategy aimed at profiting from pricing inefficiencies in mergers and acquisitions by purchasing the target company's shares at a discount to the announced acquisition price. This approach focuses on the spread rather than long-term business prospects, betting on deal completion. Investors analyze transaction terms, market conditions, and counterparty credibility to gauge transaction success, offering a concentrated, event-based opportunity for attractive risk-adjusted returns.

Mechanics and Key Components

Merger arbitrage captures the price gap between a target stock’s market price and the acquirer’s offer, driven by uncertainties like regulatory approvals or financing. As the deal nears completion, the spread narrows, yielding profit for investors. Success depends on analyzing structure, terms and conditions, timelines, risks, and external factors to execute a disciplined strategy and unlock the incremental value in merger transactions.

Identifying Merger Opportunities

Merger arbitrage captures the price gap between a target stock’s market price and the acquirer’s offer, driven by uncertainties like regulatory approvals or financing. As the deal nears completion, the spread narrows, yielding profit for investors. Success depends on analyzing deal structure, timelines, risks, and external factors to execute a disciplined strategy and unlock the incremental value in merger transactions.

Calculating Arbitrage Spreads and Potential Returns

Identifying merger opportunities involves monitoring corporate announcements and filings to spot deals where risks may be mispriced. Effective arbitragers blend quantitative metrics with insights on strategic fit and management credibility. Rigorous due diligence assesses the merger's rationale, historical performance of similar deals, and regulatory risks to identify high-probability transactions while avoiding pitfalls that could widen spreads.

Implementation Strategies Using Derivatives and Hedging

The arbitrage spread, the difference between the target’s stock price and the acquisition price, is central to merger arbitrage. Calculations factor in transaction costs, completion timelines, and deal outcome probabilities to estimate potential returns, including key metrics like IRR. Risk-adjusted return calculations, using probability models and market condition analysis, help investors evaluate opportunities, balance uncertainties, and allocate capital effectively.

Benefits of Merger Arbitrage Investing

Merger arbitrage offers built-in risk mitigation, with losses often capped by the spread's divergence from the breakup value, creating a safety net against broader market swings. This strategy requires modest capital while capturing a defined spread, yielding attractive risk-adjusted returns. Its flexibility allows investors to tailor strategies to their risk tolerance, making it a valuable addition to diversified portfolios.

Risks and Challenges Inherent in Merger Arbitrage

Merger arbitrage faces risks like completion uncertainties from regulatory hurdles, legal challenges, or market sentiment shifts, exposing investors to residual spread risks. Liquidity constraints and high transaction costs further threaten profitability, especially in less liquid securities.

Success requires rigorous due diligence, comprehensive analysis, and expert execution to overcome these obstacles. This strategy, despite its challenges, offers a nuanced investment approach with tailored opportunities and risk management techniques, fitting seamlessly into diversified portfolios.

Having clarified the key aspects of merger and acquisition arbitrage, it's important to weigh its overall effectiveness. Let’s now examine the disadvantages of this strategy to gain a balanced perspective.

What Are the Disadvantages of Merger Arbitrage Strategy?

What are the disadvantages of arbitrage strategy? In the following synopsis, the focus shifts to the inherent drawbacks of merger arbitrage, including its capped profit potential, substantial transaction costs, and vulnerability to liquidity challenges during market downturns.

Limited Upside Potential Compared to Pure Equity Investment

Merger arbitrage offers relatively modest returns, as the profit is capped by the narrow spread between the target’s current stock price and the acquisition price.

Unlike pure equity investments, which can yield significant gains if a company’s value increases substantially, the merger’s arbitrage’s upside potential is inherently limited. This characteristic makes it less appealing for investors seeking high-growth opportunities, as it prioritizes stability over substantial capital appreciation.

Higher Transaction Costs Compared to Passive Investment Strategies

Frequent trading in merger arbitrage results in higher costs, including fees, commissions, and bid-ask spreads that narrow profit margins. Passive investments like index funds or ETFs, with lower turnover and minimal expenses, preserve capital more effectively. The strategy’s elevated cost structure demands precise execution to justify its risk-reward profile compared to less active alternatives.

Potential for Liquidity Issues During Market Downturns

Illiquidity in merger arbitrage poses challenges, as reduced trading volumes during market downturns can delay entry or exit at desired prices, hindering spread convergence and affecting returns. Heightened volatility exacerbates these risks, forcing unfavorable trades or prolonged holding periods, widening spreads instead of narrowing them. Along with limited upside and high transaction costs, liquidity constraints underscore the importance of careful execution and risk management in this strategy.

Merger Arbitrage – Here’s What People Also Ask

Investors' curiosity fuels enhanced insights and leads to more prudent decisions. Now, we address key questions about merger arbitrage from real-life examples and yield insights to calculation techniques and associated risks. This comprehensive overview is designed to equip you with the actionable knowledge needed for informed investment choices.

What is a Real-Life Merger Arbitrage Example?

In the 2018 acquisition of Time Warner by AT&T, hedge funds like Elliott Management successfully engaged in merger arbitrage by purchasing Time Warner shares below the $107.50 per share acquisition price.

Despite regulatory challenges, the merger closed, enabling investors to profit from the narrowing spread. This strategy yielded annualized returns of approximately 5-8%, reflecting the calculated risk and timing involved in capturing the price discrepancy.

What are Merger Arbitrage Situations?

Merger arbitrage occurs when investors buy a target’s shares to profit from the price gap between its market price and acquisition price, betting on the spread narrowing as the deal progresses. Success hinges on evaluating the deal’s probability and associated risks, as not all transactions close as planned.

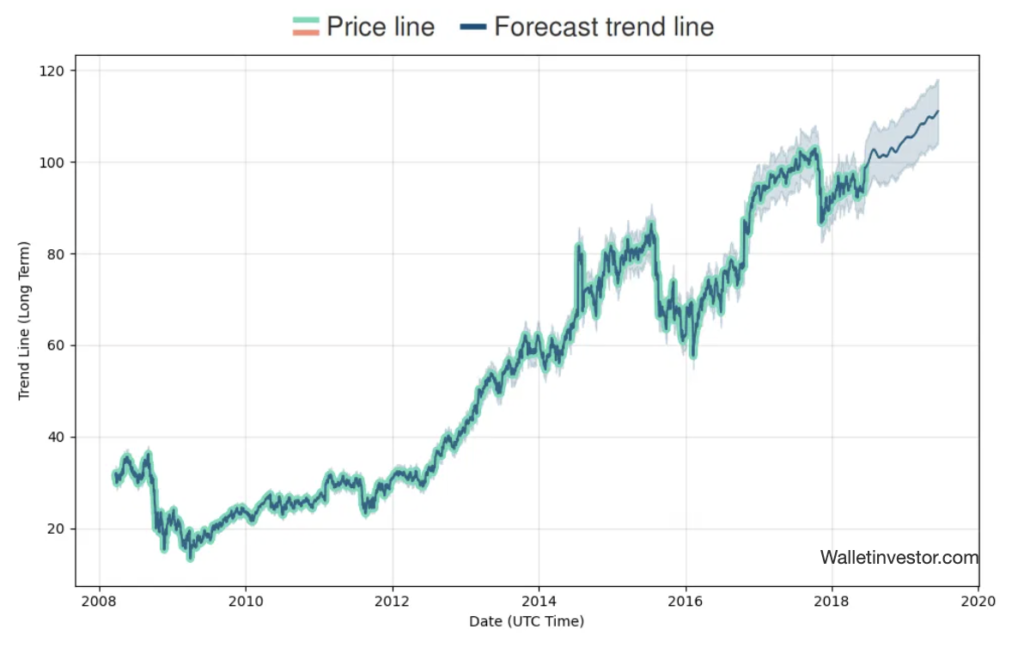

What is the Average Return of Merger Arbitrage?

The average annual return of a merger arbitrage is typically 3% to 8%, varying with transaction specifics and market conditions. These modest gains reflect the strategy’s focus on predetermined spreads rather than significant price growth, offering lower volatility and risk-adjusted performance compared to pure equity investments.

What is the Merger Arbitrage Yield?

The merger arbitrage yield is the annualized return from capturing the spread between the target’s market price and the acquisition price, calculated by considering the spread, transaction timeline, and associated fees and costs. While it varies by deal risk, the yield is modest compared to high-growth strategies.

Is Merger Arbitrage Profitable?

Merger arbitrage can be profitable when deals close successfully and spreads converge to the announced acquisition price. However, profitability is often constrained by transaction costs, anticipated and unanticipated delays, or failures, which can erode returns. While it offers stability and lower volatility compared to other strategies, its returns tend to be modest, favoring predictability over explosive growth.

How to Play Merger Arbitrage?

Merger arbitrage involves buying the target company’s stock at a discount to the offer price after a merger or acquisition is announced, aiming to profit as the price gap narrows upon deal completion. Investors often use hedging or derivatives to manage risks tied to uncertainties in the transaction.

Is Merger Arbitrage Risk Free?

The arbitrage strategy carries risks, including deal delays, changes, or failures that may result in losses. Market volatility, regulatory shifts, and liquidity challenges can further erode returns, despite its lower volatility compared to traditional equity investments.

Is Merger Arbitrage a Hedge Fund Strategy?

Yes, merger arbitrage is popular among hedge funds for its market-neutral returns, which are uncorrelated with overall market movements. By using sophisticated models to assess deal probabilities and manage risks, it diversifies portfolios and delivers steady, though modest, returns.

What are Sources of Risk in Merger Arbitrage?

Sources of risk in merger arbitrage include the possibility of deal failure due to regulatory hurdles, shareholder disapproval, or unforeseen legal challenges, which can prevent the merger from closing. Market volatility and changes in investor sentiment can also affect the price spread, eroding potential profits.

Liquidity issues, high transaction costs, and delays in deal completion pose further risks, making thorough due diligence and risk management essential for mitigating uncertainties.

How to Calculate Merger Arbitrage?

Calculating merger arbitrage involves adjusting the spread between the target's share price and the offer price for the transaction’s timelines, fees and costs, and completion probabilities to estimate returns, using metrics like IRR and annualized yield for risk-adjusted performance.

What Are the Different Types of Merger Arbitrage?

Different types of merger arbitrage strategies include cash arbitrage, where the target is acquired for cash, stock-for-stock, and/or a combination of the two. Addressing common questions in Merger Arbitrage: People Also Ask provides valuable insights into this nuanced strategy.

With a clearer understanding of merger arbitrage investing, as well as the concepts outlined in Merger Arbitrage Explained, we can now return to the fundamentals. Let’s take a broader look at merger arbitrage to reinforce the key principles and strategies behind it.

Merger Arbitrage Overview …

Merger arbitrage is an investment strategy that profits from the price discrepancies during mergers and acquisitions by capturing the spread between a target company's stock price and its acquisition price. Key takeaways include its relatively stable, risk-adjusted returns, reliance on thorough due diligence, and its unique ability to provide market-neutral diversification. However, the strategy comes with challenges such as limited upside potential, regulatory risks, and market uncertainties.

This event driven approach demonstrates resilience across various market conditions, offering opportunities to hedge against broader market volatility. In bullish markets, merger arbitrage allows investors to capitalize on increased M&A activity, while in bearish conditions, it provides a defensive approach with predictable returns. Its adaptability makes it a valuable addition to a diversified investment portfolio, tailored to individual risk preferences.

Looking forward, merger arbitrage presents opportunities for innovation through advanced deal probability modeling, refined hedging techniques, and more efficient execution strategies. The integration of big data analytics and artificial intelligence could further enhance decision-making and risk assessment, unlocking untapped potential within the strategy.

As the financial landscape evolves, continued research into the dynamics of M&A activity and regulatory environments will be crucial. Advancements in technology and market intelligence may uncover novel approaches, ensuring merger arbitrage remains a robust and profitable strategy in diverse and changing markets.

Now, the best place to find merger arbitrage stocks are via our free Morning Brew newsletter. Each month, we send subscribers each and every deal we find. Enter your email in the inbox below because it’s tough to keep track of all the deals on the horizon.

Read Next: