Original article dissecting index investing was written by Mark Gaffney.

Despite what Warren Buffett says, passive index investing is a bad bet. You would be much better off utilizing a great active strategy, such as looking for upcoming spinoffs.

On January 1, 2008, Warren Buffett, the king of value investing, famously bet $1 million that over the next decade passive index investing—buying and holding a fund that tracks a broad stock index--would outperform active management strategies.

The Oracle of Omaha wagered with a New York hedge fund that a Vanguard S&P 500 index fund would beat a basket of actively managed hedge funds over a ten year period. At the end of 2017, loser donated $1 million to their favourite charity. You can guess who that was.

Buffett didn’t get to be the fourth richest man on the planet by making dumb bets, so it’s no surprise that, with two years to go, the CEO of Berkshire Hathaway is winning the wager. The Vanguard index fund was up about 65% compared to the fund of hedge funds return of around 22%.

When Mr. Buffett talks, people listen, so individual investors with a ten year horizon may be inclined to take the Oracle’s advice, and place their retirement savings in an index fund. After all, the idea of 7-8% annual returns—the 10 year average returns of Vanguard’s S&P 500 index funds—sounds very compelling.

The first index fund was established by the Vanguard Group in 1975. John Bogle--“the father of passive investing”--built the concept into a $3.6 trillion index fund empire. Index funds are based on his belief--shared by Buffett—that most active managers cannot pick more winning stocks than someone passively holding a basket of public companies. The high fees and transaction costs of traditional mutual funds virtually assure underperformance vs an index over time.

But index fund buyers should beware -- index investing at this point in time would be a mistake. A potentially huge mistake. Here’s why:

Passive index fund investors typically earn returns much less than they planned on. And buying an Index Fund in today’s world of sky-high equity valuations will make index investing performance even worse, dooming investors to terrible returns in the months and years ahead.

Most “passive investors” only think they’re passive investors. In truth, it’s impossible to give up active investing. The reason is because you can’t avoid making decisions regarding what to invest in and how much to invest. All you can do is just shift the point at which you make investment decisions.

For Americans, the default choice are American index funds that mirror American indexes. Most American indexers buy ETFs or index funds through their bank that track US markets. This itself is an investment choice. By buying American indexes, or indexes in your home country, you’re in effect saying that these indexes will do well over time, they’re going to be both safe and profitable. Otherwise… you’d never invest.

In actuality, index investors can select from a large number of index funds from all over the globe. Like curry? Indian indexes. Sick of renovating old homes for profit? Real estate indexes. Enjoy BMWs? Try German indexes. Want something a little more close to home? There’s always Canada, the Great White North… Smart index investing requires understanding market valuations and risk measures associated with markets around the globe, and selecting an index fund that is truly safe & promising. Not doing so isn’t passive… it’s irresponsible.

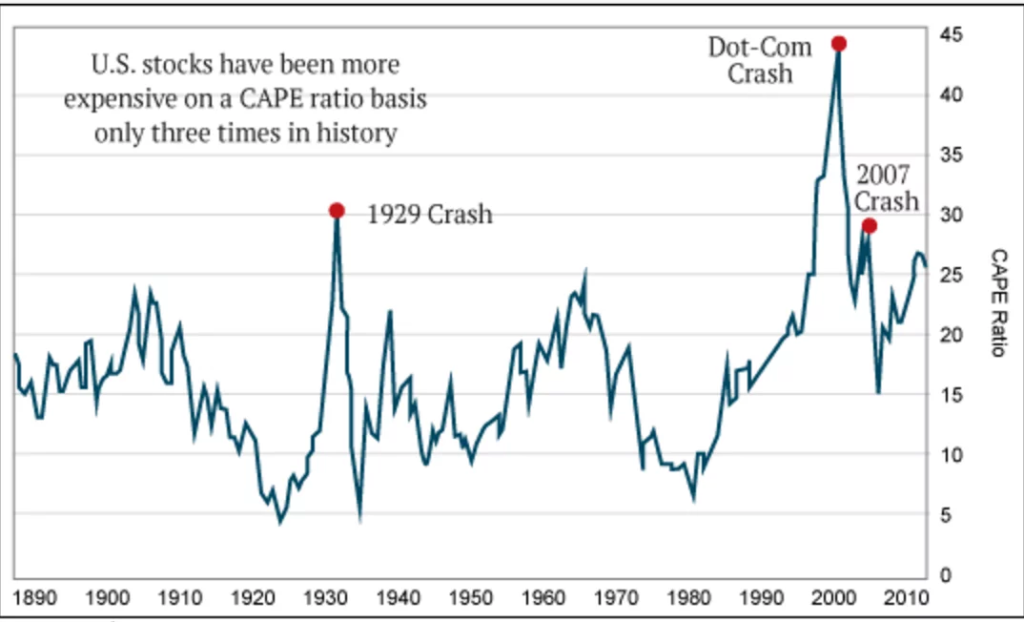

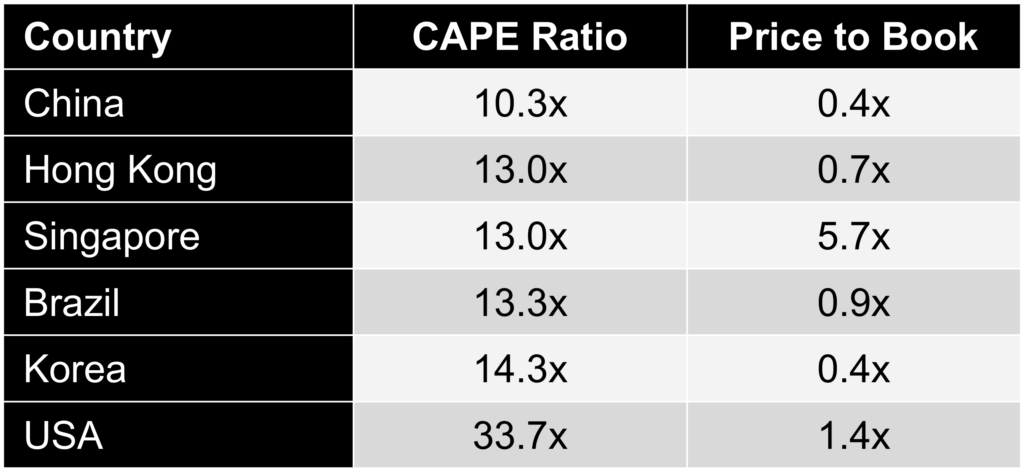

Investors who don’t understand this basic fact are going to be paying a very steep price. By historic standards, many western markets are trading at sky-high valuations. The S&P 500 int he US in particular traded at a Cyclically Adjusted Price to Earnings (CAPE) of 34x in March 2024, compared to a historic average of around 16x. Compare that to Singapore which was trading at a CAPE of just 13x.

According to research by Star Capital, the S&P’s return from current historically high valuations can be expected to be in the low single digits annually in real terms for the next 10 to 15 years. An index investor in our current environment will likely have to endure a prolonged period of stock market underperformance--or worse, a substantial fall in prices. A compound return below 5% is just not enough to build up a decent retirement portfolio.

By comparison, cheap international markets around the world such as Singapore can expect much higher returns, some in the neighbourhood of 9 or 10%. Not doing your homework can be very expensive.

But there’s another major problem with passive index investing: Most investors fail at it. Academic studies have shown, and anecdotal evidence confirms, index fund investors don’t achieve the buy-and-hold returns advertised by funds like Vanguard.

The reason? Investors make emotionally driven decisions that sabotage the passive index investing strategy, just like active investors do. Placing a chunk of one's wealth in an investment, then ignoring it until the money’s needed, sounds simple. But like many things in life, “simple” is more complex than expected.

Let’s say you mirrored Buffett’s bet and invested $100K in a Vanguard S&P index fund on January 1, 2024. Based on an expected 6% return, you calculate that in ten years you’ll have, after taxes, about $180,000 for retirement. Beautiful.

But as soon as you buy shares of the fund, its price drops. You know this because, despite your best intentions to ignore the S&P 500, you are constantly informed by financial websites, media, coworkers and neighbours, what the market is doing. You can’t avoid it—you’re following the gyrations of your wealth. And each update you receive produces an involuntary response in your brain—pleasure when value increases, pain when your wealth declines.

One year after initiating the 2024 S&P 500 index investment, your $100K is down to $60K—you’ve lost 40% amidst a financial crisis. Your $180K retirement feels a long ways off. You are worried—what’s to stop the market from declining further? You wake up mornings and watch CNBC. Anxiety about your investment shadows you throughout the day. Finally, nearing your emotional breaking point, you sell. Inevitably, the price soon reverses and begins to rise. Weeks after selling you decide to get back in…So much for passive investing.

The concept of being a passive index investor is wonderful, but living through the daily volatility is something else entirely. Emotionally driven decisions lead to long-term under-performance below the “goal based’ financial projections of most investors. The only solution to this is to develop the same strong emotional temperament that successful active investors have to develop.

Meanwhile, how many index funds does the Oracle of Omaha have in Berkshire Hathaway’s portfolio? The answer is zero.

Buffett hasn’t built his wealth passively seeking the “average” returns of the market. Buffett—following the tenets of his mentor Benjamin Graham—has succeeded by actively buying good businesses trading at a discount to intrinsic value, and holding for the long term. His best returns were when he was buying deep value stocks in the 1960s.

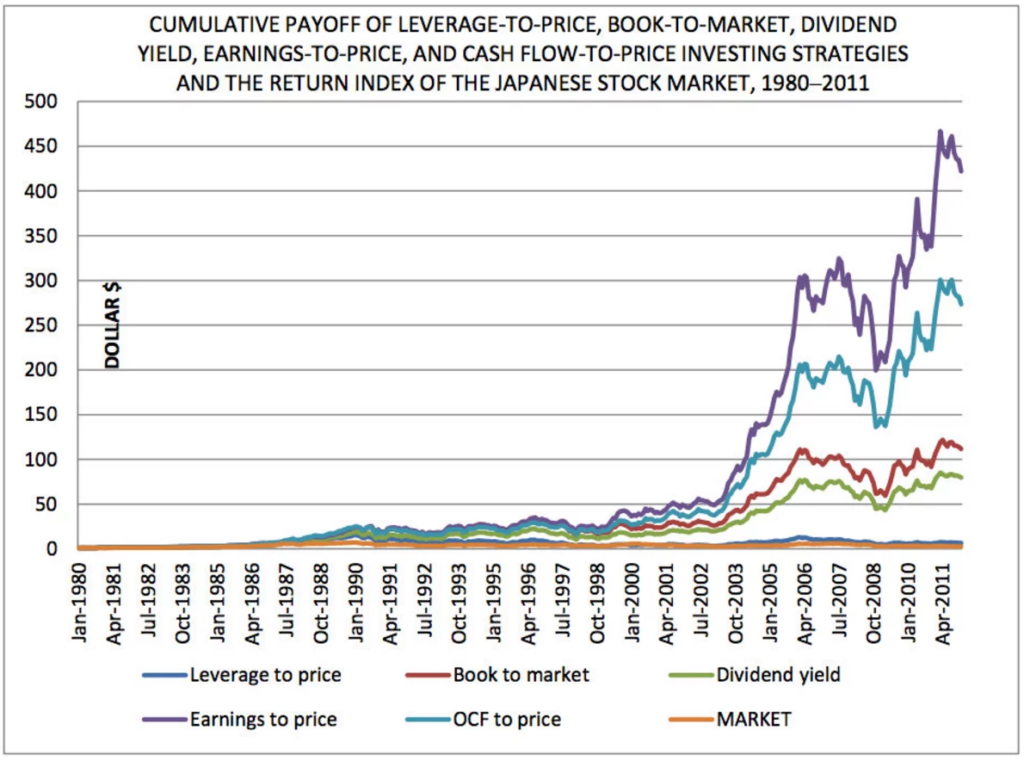

We don’t recommend that you go out and try to copy Warren Buffett by trying to buy great businesses. That’s a trap that many investors fall into. But, it is possible for private investors to build their own “index” by selecting deep value or special situation stocks that are cheap relative to one or more value metrics, such as spinoffs trading well below their comparable peers on tan EV to EBITDA basis. We’ve taken this approach ourselves, and it’s proven very profitable.

In addition to a solid framework for building wealth, the value investor holds a key psychological edge compared to the passive index fund holder. Among the behavioural biases that contribute to bad investment decisions is a process called anchoring. When we assess the value of something, we involuntarily seek a reference point for comparison. Research shows that if a logical anchor isn’t apparent, we’ll choose an insignificant or even random reference point.

For passive index investors, the anchor that informs their perception of the investment is price.

However, to the serious value investor, price fluctuations are inconsequential—it’s the value of the underlying assets that matter. For the value investor buying a stock, the anchor is the intrinsic value of the business. The net tangible assets of a business provide a relatively stable perceptual foundation. When prices drop, the value-anchored investor, having done his or her homework, realizes the drop in price is not a reason for panic, and may in fact present opportunity.

Contrast this with the index investor whose perception of value is tied to a random anchor --purchase price. The more the value of the investment falls, the greater the emotional pain, and the more likely he or she will abandon the investment.

Today, with few exceptions, markets around the globe are expensive. Unfortunately, a great number of passive stock investors will be buying high, selling low and inflicting great harm to their retirement savings.

The obvious alternative to index investing in the current environment (at least in our humble opinion) is to seek out cheap stocks relative to some metric of value—such as special situation investments or those trading for less than their liquidation value. For individual investors, the inefficiencies of the small cap universe offer extensive opportunity to uncover deep value. If there are few cheap stocks to be found in the West, venture out into friendly First World countries with a solid reputation for corporate governance and sound rule of law. Investors should pay special attention to countries such as Singapore, Norway, or even the UK where values are a lot more modest.

We realize that by recommending S&P index funds, Warren Buffett has the best interest of most small investors in mind. Many individual investors do not have the time or knowledge to manage their own investments, and often pay exorbitant management fees for poor results.

However, anyone intent on actively building wealth via the stock market would be well served to ignore Mr. Buffett’s advice on index investing—in this regard, you are much better off doing as Warren does, not as he says.

Enter your email address below to get the latest special situation stocks sent straight to your inbox because there are always outstanding deals to be found.

Read Next: