It may seem like a trivial difference, but the process behind a spin off vs a split off is significant and has serious implications for special situation investors.

Most everybody knows the term “spin off” but investors have much less awareness about split offs. In this article, I want to walk you through the differences, give you examples of each, and then show you how you can find great opportunities at no cost.

Ready?

Table of Contents

What is the Difference Between a Split Off and a Spin Off?

The key difference between a spin off and a split off is that a spinoff happens automatically while a split off requires a conscious choice by shareholders to exchange their shares.

In a spin-off, a parent company distributes shares of a new, independent entity to all shareholders. But, in a split-off, shareholders voluntarily exchange their parent company shares for shares in the separated entity. Spin-offs are automatic; split-offs offer choice. But both aim to create focused, standalone businesses.

Let’s dig into the nuts and bolts of these two special situations.

Spin-off vs split off: shareholder choice

In a spinoff, shareholders of the parent company receive shares in the new company, the spinco, but the parent company itself does not usually retain ownership in the spun-off entity (unless it’s a partial spinoff). Unlike with a spin-off, in a split off, only the shareholders who choose to exchange their shares end up owning the new split off entity. The parent company may reduce its shareholder base as a result.

Spin-off vs split off: ownership changes

With spinoffs, shareholders don’t lose ownership of the spun off company. Rather, they simply get additional shares in the new independent company. But, a split off involves a voluntary exchange of ownership — shareholders of the parent company decide whether to keep their parent company shares or trade them for shares in the new entity.

So, in a spin-off, the parent company’s ownership structure remains basically unchanged (same shareholders, just with additional shares in the new entity). But, in a split-off, the parent company’s shareholder roster may shrink as some opt for shares in the splitco instead.

So, What Does Split-off Mean in the Stock Market?

In the stock market, a split off is a method of distributing shares of a subsidiary to shareholders where management of the parent company forces shareholders to choose between retaining ownership in the parent and gaining ownership over the subsidiary.

It’s the classic “It’s her, or me” love triangle where you’re forced to choose between two courses of action that will affect the rest of your life (or portfolio, in this case).

And, What Does Spin-Off Mean in the Stock Market?

A spinoff is a corporate action where it separates out one of its divisions as a standalone business and then distributes the shares in that business to shareholders. The separation can be whole partial (known as a partial spinoff). But, unlike in the case of a split off, you’re not forced to choose between the parent company and the spinco.

What is an Example of a Spin-Off vs a Split-Off?

The eBay-PayPal spin-off in 2015 is a textbook case of a corporate spin-off, driven by strategic focus and shareholder value creation. Here’s the rundown:

eBay Spins Off PayPal

eBay had owned PayPal since acquiring it from Elon Musk and Peter Theil for $1.5 billion US in 2002., integrating it as a key payment system for its online marketplace. By the 2010s, PayPal’s growth outpaced eBay’s core business and PayPal was expanding into mobile payments and competing with fintech giants.

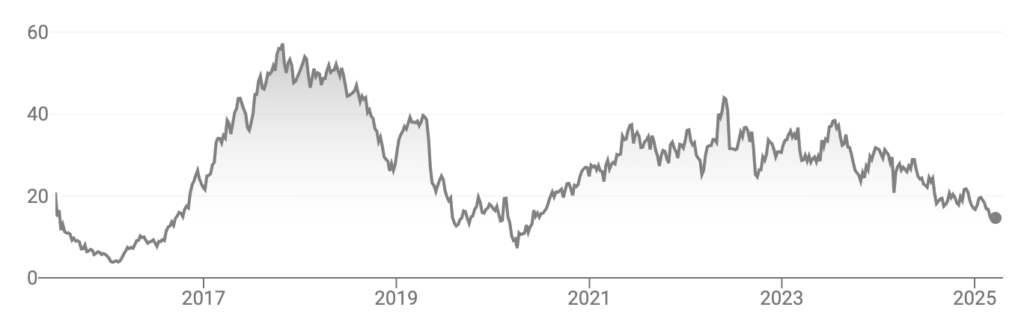

In September 2014, after significant pressure from Carl Icahn, eBay agreed to spin off PayPal as a separate company to help unlock shareholder value. eBay completed the tax free 1-for-1 spinoff on July 17th, 2015, spinning off shares at an initial price of $41.46.

Shares fell to $32.83 by October of that year, a disappointing outcome for anyone who bought on the distribution date. But, this was also textbook spinoff stock price behavior. The company rebounded in price that year and kept growing. Within 5 years, the stock reached $174 US. Investors had made 320% in just 5 years.

What is an Example of a Split Off vs a Spin Off?

The DuPont-Chemours split-off in 2015 is a strong example of a corporate split-off, where a parent company divests a business unit by offering shareholders a choice to exchange their shares for ownership in the new entity. Here’s the story:

DuPont Splits Off Chemours

DuPont is a company with a long history, most of that in industrial chemicals. In 2015, Nelson Peltz’s Trian Fund took a stake in the business, in an attempt to redirect the company towards higher growth. DuPont revealed plans to separate its performance chemicals division into a new company called Chemours.

The split-off started on July 1st, 2015. The exchange ratio was set at 1 DuPont share for 0.8747 Chemours shares, adjusted based on market conditions during the offer period. Shareholders could choose to keep their DuPont shares, swap them for Chemours shares, or do a mix of both. Those who didn’t participate stayed with DuPont, while participants became Chemours shareholders.

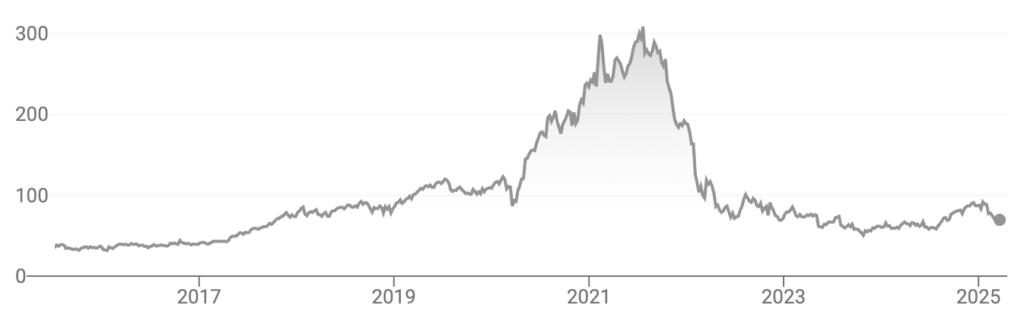

Chemours shares closed on the first day of trading at $21 per share. But, the company faced a rocky start due to weak TiO₂ prices, debt concerns, and legal battles with DuPont over environmental liabilities. Its stock dropped to just $6.50 by December 2015 – a decline of 69%. But, this proved to be a temporary storm, and the stock later stabilized then climbed above $40 by 2017.

Investors who stuck with the company from the close of the first trading day achieved a 100% return in just two years. Anyone who bought the dip, though, at – say – $7 enjoyed a much larger 470% return.

Where Can You Find Spin Offs or Split Offs?

There are a lot of great opportunities out there for special situation investors in either the world of spin offs or split offs. The problem is spotting the best opportunities before they pass you by.

You used to have to spend a considerable amount of time combing through financial reports or newspapers trying to find these gems, but now there’s a great free service that will send you notifications each month on all special situations available.

Enter your email address below to receive our free Morning Brew newsletter, listing all of the special situations we find over the course of a month, because life is too short to find them on your own.